Make money by Trading is Amazing. For me, trading is like the best job in the world, but there are many mistakes that people make. I can talk about my trading mistakes, just the ones that sometimes make me lose money in a bad way.

These trading mistakes are the most common problems for every new trader. They show also why over the 90% of traders lose money.

Definitely, I am not a great trader and I don’t want be perfect. For me is important just be able to make money consistently. I am still learning and the path to become really a profitable trader is still long for me.

In this stage of my learning process, my common trading mistakes have an emotional origin mainly.

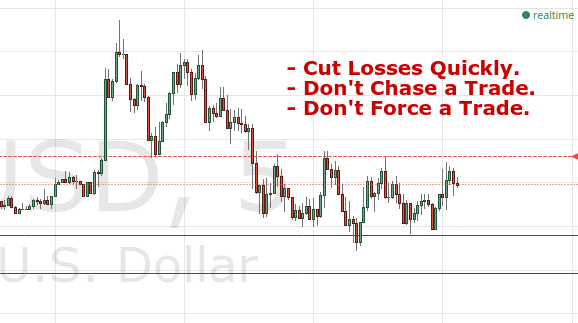

Trading Mistakes and Fundamental Trading Rules

The most common Trading Mistakes define also the most important Trading Rules. The discipline is crucial in trading business.

Let run a Trade in Loss

What I manage enough well is just the practice to Cut the Losses.

Rule #1: Cut Losses Quickly.

It is fundamental but it is not enough to make a good trader. You need to Cut the Losses Quickly, wait the right pattern and define your Risk Reward for every trade that is comfortable with your trading style.

Let run a trade in loss, over the acceptable and reasonable risk, is a damage.

It is a practice for experienced traders. But they do it only if they have a specific plan and many times they fail too.

Chase a Trade

When you plan a specific trade, keeping the focus on the breaking of a specific level, you are strongly convinced that it will be in your favor. So, if you trigger the trade and it doesn’t go as expected you get a loss. The trade got squeezed and of course a small loss is not a problem.

But if you insist stubbornly thinking that the specific level will break just in that moment or very soon and you trigger a new trade with the same intention of the first one, probably the result will be another loss.

Rule #2: Never Chase a Trade.

Many newbie traders, emotional traders, not experienced traders, make the same trading mistake more times: just chasing trades. They repeat the mistake, opening a trade over and over, following blindly their conviction without consider the real situation and losing money consistently.

It is just Chase a Trade stubbornly.

But also when you are waiting for the breaking of a specific level and it happens when you are not ready, don’t try to trigger the trade in the running. it is just Chase a Trade. Don’t do it. Don’t Chase Trades. The chart could be already over extended and your trade could get squeezed, because you opened too late chasing it.

Force a Trade

Chase a Trade is the same that Force a Trade. But the practice to Force a Trade happens in several situations. The most common ones are when the market is slow, the chart is choppy. Then, there is no relevant trading opportunity and high risk.

The common habit for every new trader is just the one to find a way to open a trade every time that he is monitoring the market. In practice it means: follow the market and trigger the trade also if there is no good opportunity. This is a bad practice that gives high risk.

In reality, we don’t need to trade every time or every day. We should consider to trigger a new trade when the situations shows a trading opportunity that can give a good profit, making a good evaluation of the Risk Reward. This also let us avoid the failing practice of the Over Trading.

Rule #3: Don’t Force a Trade.

For example, there is not sense to risk $0.50 per share for only a $0.05 per share of profit. Just like there is no sense to risk 30 pips for just 3 pips of profit.

Force a Trade is very common practice that traders make in any moment. It happens particularly when the market is slow. But also experienced traders make this particular mistake.

Conclusion

These are the Fundamental Trading Rules that I try to follow and they show the main Trading Mistakes that I do. Follow the rules is not easy. I do my best and day by day I improve my trading practice.

It gives frustration sometimes but Trading Mistakes are necessary and they are almost inevitable when a new trader begins of this amazing adventure. The Learning Process should never stop.

Cut Losses Quickly. Never Chase a Trade. Don’t Force a Trade.

Leave a Reply