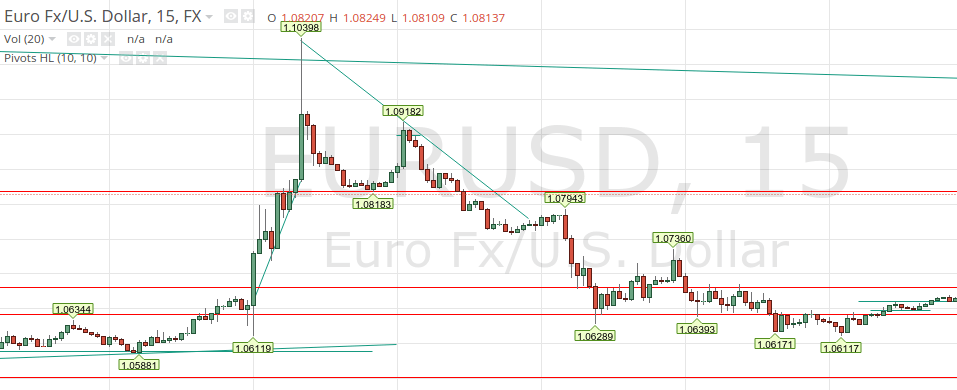

The Volatility that the Federal Open Market Committee (FOMC) induced to Currencies with USD March 18, 2015, Overextended the EURUSD Chart, giving a very strong rising up to the currency price. When the climbing got Exhausted it Faded Down Deeply.

This Overextended Chart scenario for EURUSD is Great and it is like a Pattern to trade many and many times.

This Overextended Chart Pattern is Totally Predictable, by News Catalysts and Price Action. it could be traded running the up front, and in the fading when the reversal signal is recognizable. Manage the risk properly and this Pattern will pay you as well.

Learn the Pattern. Trade it. Make Profit. Rinse and Repeat.

Surely some of the trades opened can fail in the case of high volatility. But traders that know the situation are provident letting close to zero or with a small profit the most of these trades. Zero is better than a loss. In the scenario where the volatility defines success and failure of a trader, there are many opportunities to open new trades.

The Worst and the Best Charts

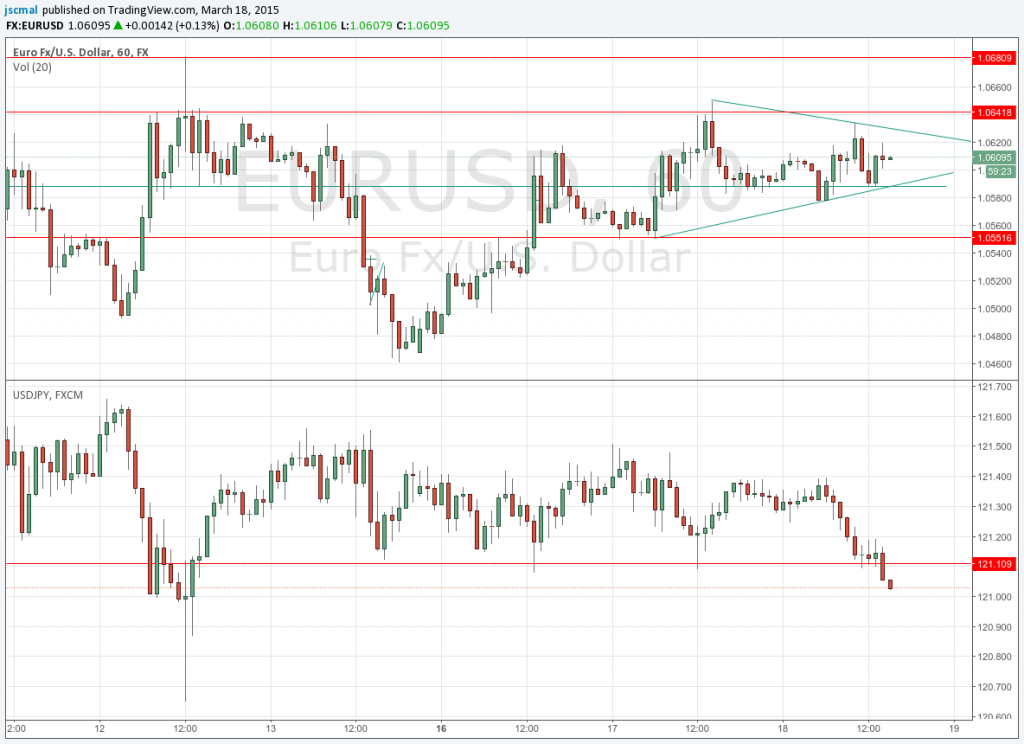

Some times the chart is Choppy, Slow and Bore like the EURUSD and USDJPY charts in this tweet. In this case what to do is just have patience to wait or lose money. A slow and choppy chart increases the risk to lose money.

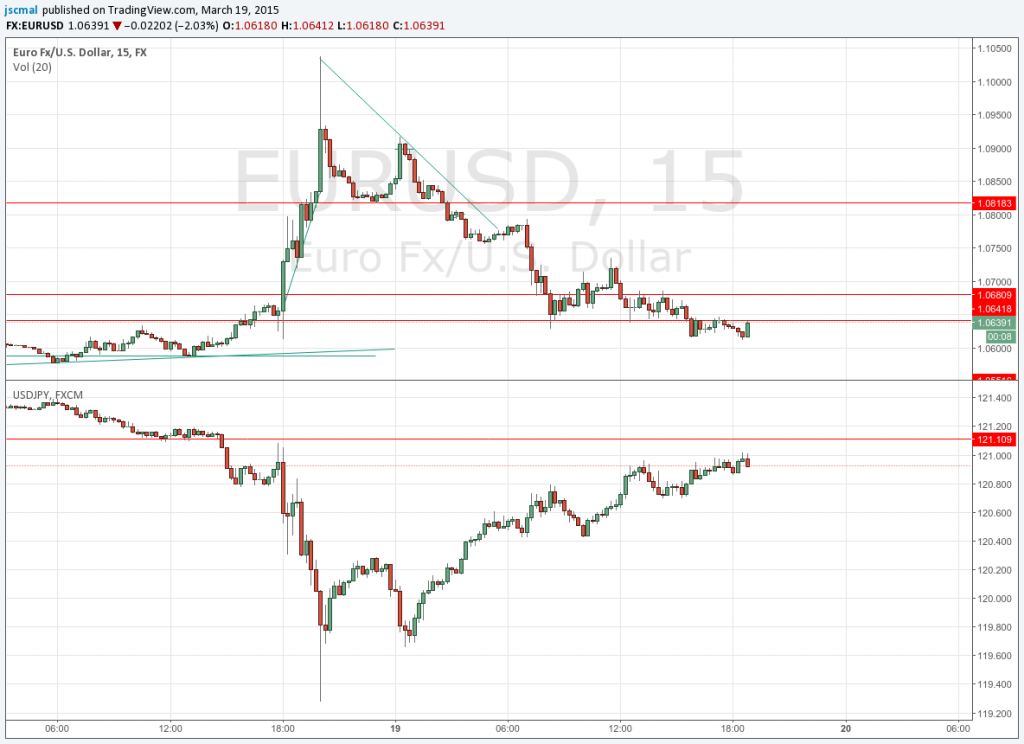

Other times instead, the Chart is Totally Predictable and with Enough Volatility like the EURUSD and USDJPY in this tweet. It lets really make money, making the day one of the best of your life.

Note: Why have I always a double chart EURUSD and USDJPY?

At the moment I use charts in this way because EURUSD has a strong sympathy with USDJPY by the USD correlation among them. This is really useful to understand whether EURUSD is breaking a specific level, taking attention to the behavior of USDJPY. The two currencies have an opposite trend mostly.

Overextended Chart. My Trading after the FOMC

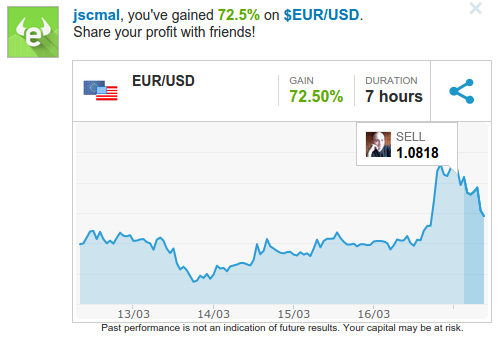

I made a lot of money Selling the EURUSD Overextended chart, after the spiking up. EURUSD spiked for hundreds of pips and it was not expected.

Many traders have seen their trades blown away, because the spike has eaten Stop Losses one by one. Also my copy trading portfolio experienced a huge loss. But the trader that I copy has cut the losses before to nick the Capital Invested. Later he sold EURUSD enough aggressively to turn again the Equity in profit as well.

In the EURUSD Overextended Chart I waited a reversal signal to understand if there were possibilities to sell. The chart showed significant Higher High and Lower High just on the top.

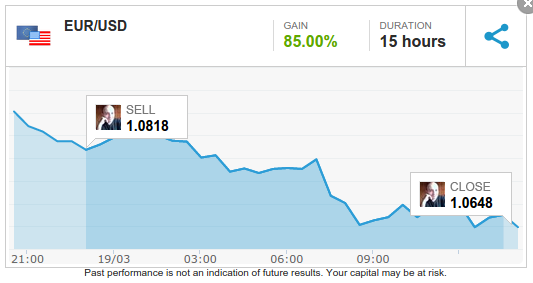

I didn’t sell the Parabolic Pattern after the long tail in the first High. But I sold EURUSD progressively after the Lower High.

I was not sure to sell because the volatility gives always high risk. Then I opened my first sells with a low amount and leverage 50x. When the EURUSD confirmed the fading, breaking the key support 1.0818, I sold more with bigger trades and leverage 100x. The Final Goal was to hit 1.6000.

I closed the biggest trades at their Take Profits, putting the huge profits in the pocket. I left run the smaller ones opened at higher prices, hoping to reach the last goal. But it was never reached. Then, they have hit the Safety Stop Loss getting closed with huge profits for them.

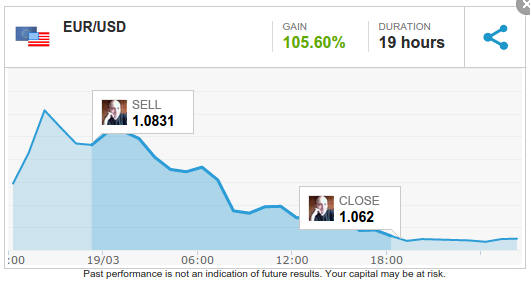

Overextended Chart. My Huge Profits after the FOMC

Here I report the trades that I closed as well as I planned, reporting also entry and exit points. These tweets show my happiness for the good trading that I had. I would think that the success in these trades is a signal that my hard work and struggle to improve my trading are paying me back. We will see in future.

I recommend you to follow me also on Twitter, to see my trades and trading discussions.

Third EURUSD Sell trade closed

Second EURUSD Sell trade closed

First EURUSD Sell trade closed

The rest of the trades (I think other 3) got closed in profit to the Safety Stop Loss.

This tweet shows what the OpenBook reported in my Feed when I woke up the day after the FOMC, when my EURUSD sell trades were still running:

As I told many times:

I don’t want be a Perfect Trader, I want to Make Money, by Manual Trading and Copy Trading, do my best in everything and have a Happy Life.

Leave a Reply